Arbitrary Coherence and Anchoring in Real Estate Negotiation

I have been moving around quite a few times. Whenever I tried to sell furniture on Facebook Marketplace, I found it super helpful to include a picture showcasing the original price, or an invoice that you paid for, if available. Chances are that I bought couch two years ago in IKEA, neither product pages are to be recovered in the fast-paced consumerism world, nor the original receipt to be kept. In these cases, finding comparable product is a good starting point to anchor my marketplace posting. Buyers rely on this information to judge if the offer is fair or attractive enough.

What if, a totally random number can also unconsciously anchor your perceptions of something that is totally unrelated? This is where “arbitrary coherence” comes in. I got to know the term by Dan Ariely’s book Predictably Irrational. The basic idea is that our behaviors and decision makings are (most often unconsciously) influenced by arbitrary things that we encounter in life. In behavior economics, “arbitrary coherence” is when an arbitrary, randomly chosen number, influences the amount purchasers are willing to pay for a product (Mattei & Hellebusch, 2020).

In the book, Ariely mentions the example of social security number influencing the customers’ willingness to pay for certain products. In the experiment, students were asked to write the last two digits of their social security numbers on the top right corner of the page, before putting down their maximum prices willing to pay for some pre-selected products with limited information, other than a short description. It turned out that the top 20 percent bid an average of $56 for the cordless keyboard; the bottom 20 percent bid an average of $16. In the end, students with social security numbers ending in the upper 20 percent placed bids that were 216 to 346 percent higher than those of the students with social security numbers ending in the lowest 20 percent. Interesting, isn’t it?

Social security number in this case served as an anchor, summoned arbitrarily, that influences future behaviors to be coherent with some established numbers, manifested by people’s willingness to pay. It doesn’t have to be social security; it can well be a wide range of things that marketers, who have been scratching their heads all along to make presentations and infographics to convince consumers that their products are better, have absolutely no control of. The truth is, customers don’t necessarily care how much the competitors’ products cost, and whether price premiums are justified, but how much they were charged yesterday for the same products, because current price is the strongest arbitrary number established for the future to stay coherent.

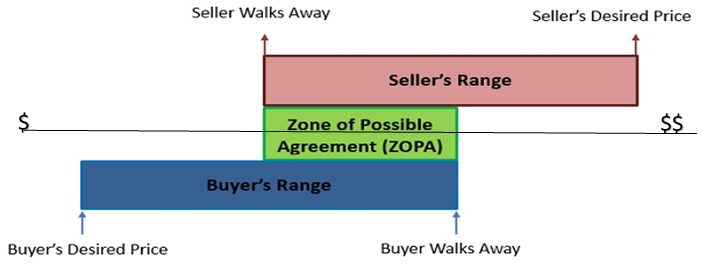

So, it logically follows that setting the anchor right, or in other words to your benefits, is very important. There are a plenty of contexts where this discussion could be applicable, but I would like to focus on negotiation in the real estate. Like in a lease rental, or single family home purchase. I learned in my real estate class of two critical concepts (very intuitive but great to be articulate): BATNA and ZOPA. BATNA stands for the Best Alternative to a Negotiated Agreement, and ZOPA for Zone of Possible Agreement. See below illustration.

A phrase made famous by Roger Fisher and William Ury, ZOPA is identifying the bargaining range or the field of play in which the two parties are about to enter (Source). The range is limited by each party’s respective BATNA, the “walk away” price point. Conversation happens when respective BATNA crosses over, that there is a zone to negotiate.

Within ZOPA, how to establish an anchor slightly to your benefits on the spectrum? First, assess the ZOPA by knowing your BATNA and guessing that of the other party. Then, submit the anchor offer to your benefits and negotiate around.

The first step requires comprehensive market knowledge, that the offer should not be out of the range. Say the market rate for a home of comparable size, layout, and location ranges from $600k - $700k, a potential buyer submitting $400k will be absolutely dismissed. Then one might ask, how about $550? Or $580? Will such offer be taken seriously? Here it calls for due diligence on the deal you are trying to make, and knowledge to assess relative leverage/negotiating power of the other party. Or simply put, you just need to know a little more about everything than your counterpart, so you can hit their zone but not their spot. $550k could make it, if the floor is lower, the room sits on the side without much sun exposure, the seller really is looking for someone to take over asap, or another building just erected in the next block and will add hundreds of units to the market immediately etc.

Now one might assert that, such anchoring is not longer arbitrary, because the arbitrary coherence discussed above, as in the example of social security number subconsciously influencing bidding prices, exerts its magic by being total random, not carefully chosen.

My interpretation is that, in marketplace negotiation, the conversation has already been strongly anchored by the pricing of comparables. With readily available online information or paid services of market analytics companies, nowadays market participants already have vast information to frame future behaviors. So it is still arbitrary, given some prices out there, and coherent, that future deals depend on it. And, the fascinating aspect in the real estate negotiation is, that no two properties are identical, and that no two parties are in the same situation, which is why there is BATNA and ZOPA, and why a negotiation is due to happen before settlement. Therefore, although we can exercise none influence to the strong anchor signaled from and by the market, we can chime in and anchor the first offer slightly to your advantage within the spectrum of ZOPA.

The similar logic could also be used the other way around, that we should be conscious of the offer submitted by others. Think about the legitimacy of such offer before jumping right in and making a counteroffer. Check if their comparables are truly comparable. Most importantly, make your own independent judgement before entering a negotiation. The truth is, no matter who is making the first offer, we still got works to do.